What is a short-term loan?

A short-term loan is an unsecured cash loan designed to help you until your next payday. Customers choose short-term loans to cover small, unexpected expenses while avoiding costly bounced-check fees and late payment penalties.

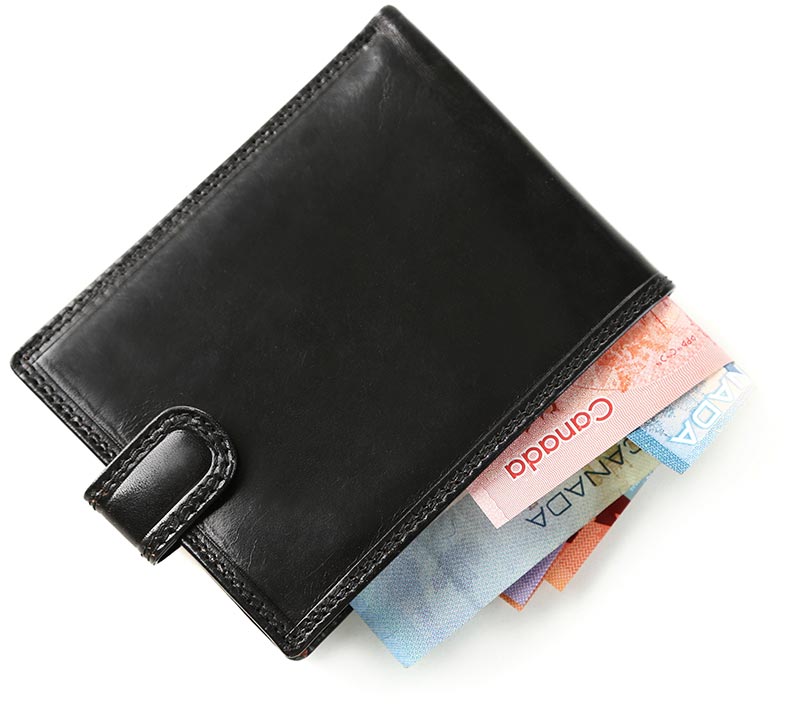

How much can I borrow?

Usually, short-term loans range from $100 - $1500. The lender will decide, based on your application, how much you can qualify for. After successful repayment of your loan, your loan amount may increase on any future loans.

When can I get my money?

Once approved, most short-term loans are electronically deposited directly into your account within 24 hours excluding weekend and holidays.

Do I qualify for a short-term loan?

First, you must be 18 years or older and a legal resident of Canada. Most lenders only require that you have an active bank account and receive over $800 a month in take home pay. A valid email address and working phone number are also required.

What if I have bad credit?

Short-term loans are available to borrowers of all credit types. Even with bad credit you can still qualify for a loan. Your credit score is not a factor in receiving the loan in most cases.

What types of fees are involved?

The lenders in Trusted Loans Online's network are very competitive with their fees. Short-term loans can be more expensive than traditional bank loans and are only intended for short-term needs. Please be sure to understand all terms and costs before accepting a short-term loan.

Are there any restrictions on use of funds?

No, you may apply for and use the loan for any purpose you choose. Common uses for short-term loans include paying bills, avoiding late fees, helping with rent or mortgage, or simply needing extra cash before the next paycheck.